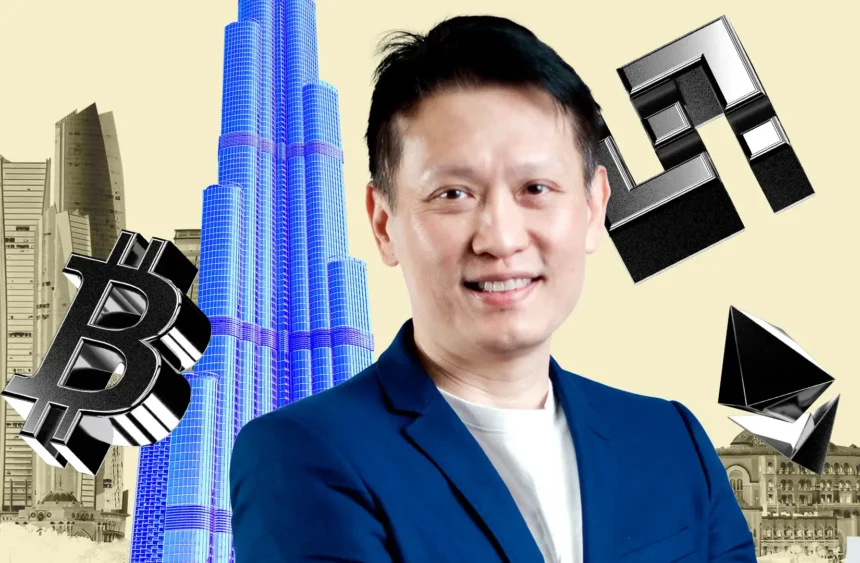

Binance CEO Richard Teng has publicly denied allegations that the world’s largest cryptocurrency exchange influenced the selection of USD1, a stablecoin tied to a Trump family-backed crypto firm, for a $2 billion investment deal with Abu Dhabi-based MGX.

According to a CNBC report, Teng clarified that Binance had no role in determining which stablecoin would be used for the MGX transaction. His comments come amid growing scrutiny following former President Donald Trump’s pardon of Binance’s ex-CEO Changpeng Zhao, an event that sparked widespread accusations of political favoritism and corruption in the crypto industry.

Binance Distances Itself from USD1 Selection

Teng emphasized that the decision to use USD1 was made solely by MGX and not influenced by Binance. The $2 billion investment, originally announced in March, quickly drew attention after Eric Trump reportedly suggested that the deal would benefit the Trump family’s business interests.

Despite Teng’s assurances, Bloomberg published a report claiming Binance may have contributed to the development of USD1. In response, Changpeng Zhao is said to be considering legal action against the publication for its claims.

Political and Regulatory Concerns Grow

The controversy has also attracted the attention of U.S. lawmakers, who are questioning the Trump family’s connections to Binance and the potential promotion of Trump-related cryptocurrencies. These concerns come at a time when both the crypto market and regulatory landscape in the U.S. remain highly sensitive to issues involving political influence and financial transparency.

While Richard Teng maintains that Binance remains fully compliant and independent, the exchange continues to face intense public and governmental scrutiny as it navigates its post-Zhao era and works to rebuild trust within the global crypto community.