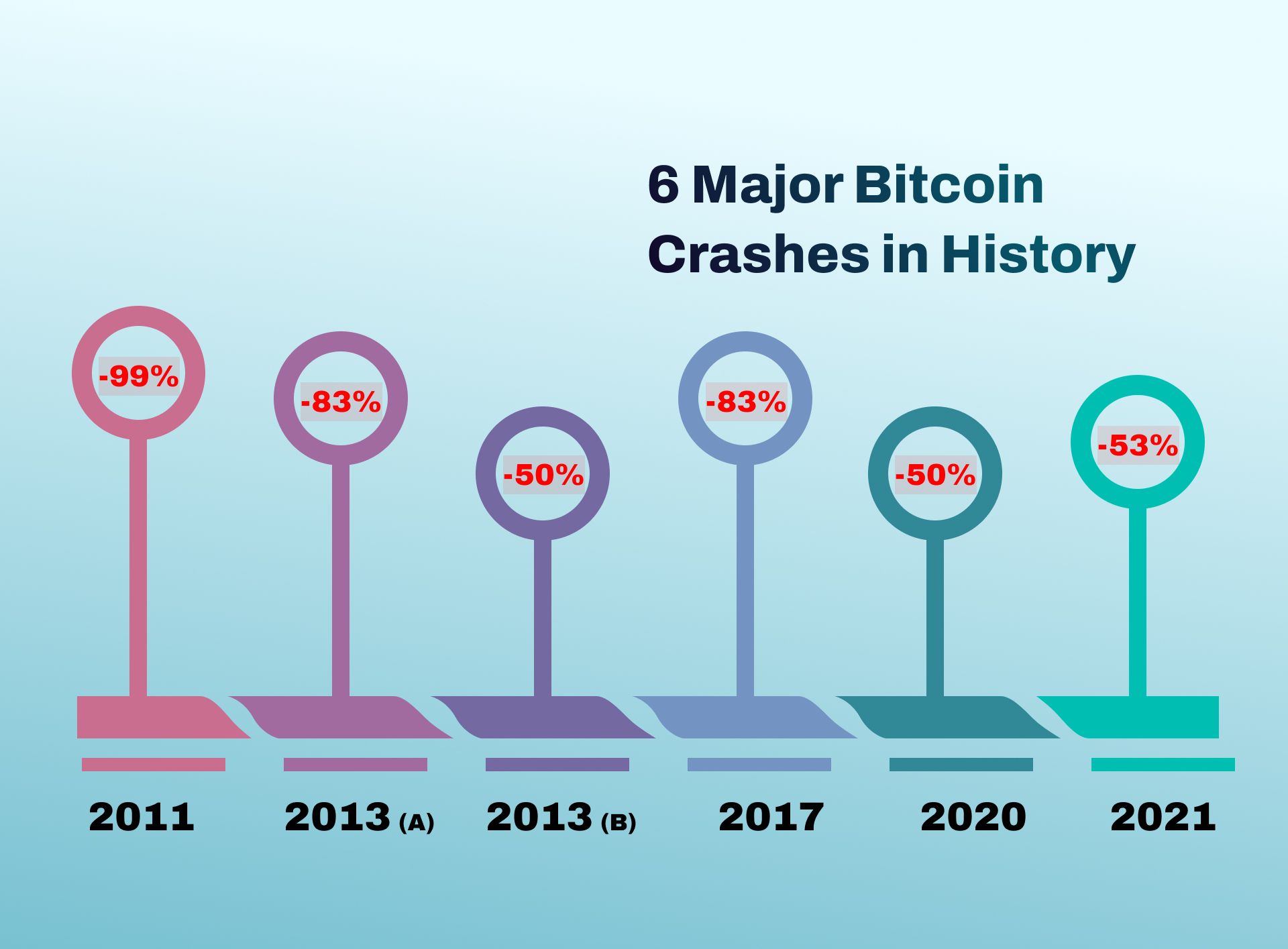

Cryptocurrency like Bitcoin is both interesting and risky because it changes easily. The Bitcoin price crash has shaken buyers’ faith in the cryptocurrency market. Every Bitcoin price decrease has shown how powerful it is since the market has recovered phenomenally. This article covers the biggest Bitcoin falls in detail. It will examine each and how the market recovered. Understanding these cycles might help investors comprehend Bitcoin recovery trends in the cryptocurrency market. This will demonstrate that the market can grow even during a short-term decrease.

The 2011 Bitcoin Price Crash: From $32 to $2

What happened: The Bitcoin crash 2011 was its first significant drop. The Bitcoin price plunged from $32 to $2 in a few months, worrying early users.

Cause: A significant security breach at Bitcoin Mt Gox, a popular platform, caused this early Bitcoin price drops. This hack caused investors to lose faith in the market, causing a massive sell-off.

Recovery: Small tech groups noticed Bitcoin’s potential and used it again cautiously. This crash was a loss, but it improved security and led to Bitcoin’s first recovery, proving it can survive in a changing market.

2013 Bitcoin Price Crash: Regulatory Woes and Market Fear

What happened: Bitcoin soared above $1,100 in 2013. It dropped swiftly to $200. The Chinese government made Bitcoin trading difficult, causing this Bitcoin price drop 2013.

Cause: The first major China Bitcoin ban revolutionized the cryptocurrency market. China’s confusing laws and harsh crypto regulations spooked the market. Buyers sold swiftly. Bitcoin struggled, but the following year improved.

Recovery: After positive coverage and global adoption, cryptocurrencies became popular again. Bitcoin’s value surge highlighted its strength and decentralized currency growth potential. Even if officials struggle and the market worries, it establishes the framework for future prosperity. Bitcoin’s 2013 fall was significant in banks.

2017 Crash: The Burst of the ICO Bubble

What happened: The Bitcoin crash 2017 changed cryptocurrencies. Many individuals wanted to buy Bitcoin in December 2017, when it hit around $20,000. The ICO bubble broke swiftly, and by late 2018, the price had plunged below $3,000. This started a market-wide cryptocurrency crash.

Cause: Many factors caused this accident. People speculated on ICOs that couldn’t last, raising prices and creating attention. Lawmakers worldwide opposed numerous ICOs, casting doubt on their legitimacy and scaring investors.

Recovery: After a difficult start, the market improved in 2019. Bitcoin and the cryptocurrency industry gained confidence due to institutional involvement and improved infrastructure, such as safer platforms and more precise rules. This enabled future market growth.

The COVID-19 Crash (March 2020): A Flash Panic Sell-off

What Happened: Bitcoin plummeted significantly in March 2020. Within days, BTC fell from $10,000 to under $4,000. Many call this major decline the Bitcoin price crash March 2020.

Cause: A virus spooked every market worldwide, like the COVID-19 Bitcoin price drop. Buyers hurried to sell assets for cash, devaluing BTC and other financial markets.

Recovery: Bitcoin remained powerful after the initial shock. Government support and a return of interest from individual and institutional investors who saw Bitcoin as a hedge against inflation drove the crypto market recovery.

SEE ALSO: What Really Drives Bitcoin Price? An Essential Beginner’s Guide to Market Trends

2021 Crash: Elon Musk’s Tweets and China’s Mining Crackdown

What Happened: Bitcoin’s value peaked at $64,000 in 2021. After a few months, it plummeted below $30,000. One of the biggest bitcoin market occurrences was the Bitcoin price crash 2021.

Cause: After Elon Musk Bitcoin criticized environmental impact, investors lost faith. This caused most of the crash. China outlawing crypto mining exacerbated the market panic.

Recovery: It succeeded despite these challenges. Miners were welcomed in the US and Kazakhstan despite the China crypto ban. Many companies started accepting crypto payments, boosting Bitcoin’s global financial status.

Lessons Learned from Bitcoin Crashes

Bitcoin crashes’ cryptocurrency investment lessons can aid new and seasoned investors.

Volatility as an Opportunity: Bitcoin’s volatility can be an opportunity for long-term buyers. Markets sometimes rise and fall, and investors might buy at lower prices and profit from growth.

Effects of New Rules: The new rules significantly impact Bitcoin market trends and short-term volatility. Updated laws help investors prepare for price swings.

Influence of External Events: Pandemics and government actions affect Bitcoin prices. Knowing these things helps you comprehend Bitcoin crash recovery and make good investments.

How Bitcoin Has Proven Its Resilience Over Time?

Bitcoin has increased in value despite multiple short-term losses. This proves its durability. A significant Bitcoin price recovery generally follows a loss, making investors more optimistic. This trend has more skilled investors, which is essential. This shows that cryptocurrency acceptance is growing. Bitcoin is also becoming more popular worldwide as countries and organizations recognize its value as a currency. This confluence of factors highlights the need of long-term Bitcoin investment as the cryptocurrency sector matures.

Future Outlook: Can Bitcoin Continue to Recover from Market Crashes?

Several trends suggest a bullish Bitcoin price outlook. Regulatory approval of Bitcoin ETFs could boost institutional funding. However, Bitcoin is becoming an asset class as more countries use it. Bitcoin’s system improves as blockchain technology does. That makes it safer and more valuable. Coins will drop again, but past trends prove Bitcoin’s strength. Long-term investors can stay bullish on current crypto market trends and Bitcoin future predictions. Investors who anticipate market fluctuations can maximize Bitcoin’s recovery and growth. Bitcoin’s place in global finance will be safer.

Conclusion: Riding the Waves of Bitcoin’s Volatility

Finally, Bitcoin’s price has risen, which generally boosts the market following a crash. The fact that this pattern persists confirms Bitcoin’s cryptocurrency leadership. In the stormy waters of cryptocurrency investment, investors must think long-term. Looking at Bitcoin trends and how the market can improve can transform risk into chance. BTC price declines